Written by Russell D. Garrett, Jordan Ramis Shareholder

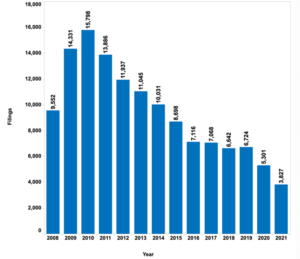

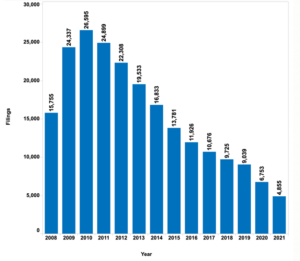

The latest bankruptcy data shows a continuing, sharp decline in personal bankruptcy filings since the start of the COVID-19 pandemic. During the first quarter of 2022, Chapter 7 filings fell by more than 30% in both Oregon and Washington.

In Washington, where I serve as a Chapter 7 trustee administering debtors’ assets (if there are any) to pay creditors, Chapter 7 filings in Q1 declined 31% compared to the same three-month period in 2021. Oregon’s Chapter 7 filings fell by even more, 35%.

This is surprising given that, in 2021, Chapter 7 filings in the two states fell to their lowest level of this century – with 8,682 filings. That number was down 45% from 2019.

Chapter 7 filings

Oregon

Oregon  Washington

Washington

Source: Administrative Office of the U.S. Courts

The same trajectory has been true for Chapter 13 filings. These cases, commonly referred to as a “wage earner’s plan” because they allow individuals to repay all or part of their debts, are down 64% since 2019 – the year prior to the pandemic outbreak.

This is interesting because I would normally expect, during a time of low Chapter 7 filings, a corresponding increase in the number of Chapter 13 filings. Instead, they are both at historic lows even as the national statistics show that the level of unsecured debt per capita is extremely high. What that suggests to me is that everybody who should be looking at bankruptcy is waiting. But for how long?

Interestingly, March’s numbers showed that Chapter 7 filings jumped significantly in both Washington (424 vs. 288 in February) and Oregon (320 vs. 220). It’s too soon to say for certain, but perhaps this signals the end of bankruptcies being artificially suppressed by federal stimulus payments (which have ended) and low interest rates (which have risen).

We may be seeing the reemergence of the usual financial pressures, such as foreclosures, wage garnishments and inflation, as they exert themselves on individuals.

As this happens, it seems likely that the economy’s release valve – bankruptcy – will open once again.

Russell Garrett is a shareholder at Jordan Ramis and focuses his practice on bankruptcy law. Contact him at Russell.Garrett@jordanramis.com.

Tags: Bankruptcy and Creditors’ Rights, Financial Services